Table of Contents

The News

The NVIDIA-Palantir partnership announced on October 27th-28th, 2025, represents a defining moment in enterprise AI deployment, creating clear winners and losers across the technology ecosystem while reshaping competitive dynamics in operational AI.

It will prove an instant win for any organisations since it offers an ‘oven ready’ AI ecosystem which accelerates the race to put AI at the heart of operations. Equally, it will be troubling to anyone concerned by Palantir’s views on surveillance and its leadership culture.

The Partnership Architecture

At the core of this collaboration lies the integration of NVIDIA’s GPU-accelerated computing infrastructure, CUDA-X libraries, and open-source Nemotron AI models into Palantir’s Ontology framework, which powers the Palantir AI Platform (AIP).

This creates what the companies describe as the first integrated operational AI stack: combining analytics capabilities, reference workflows, automation features, and customisable AI agents to accelerate complex enterprise and government systems.

The technical integration enables enterprises to deploy domain-specific AI agents across logistics, healthcare, financial services, and defense sectors.

For instance, NVIDIA’s cuOpt decision-optimisation software and AI Enterprise platform provide real-time supply chain management capabilities, while future versions will incorporate NVIDIA’s Blackwell architecture to further accelerate AI workflows.

The Winners

NVIDIA’s Strategic Gains

NVIDIA emerges as a major beneficiary by diversifying beyond its traditional hyperscaler customer base e.g. Microsoft, Amazon, and Google which currently dominate its revenue streams.

The partnership provides several advantages:

- Enterprise Market Expansion: Direct access to Palantir’s Fortune 500 client base and government contracts, opening new revenue channels beyond data centre operators

- Software Layer Integration: Extends NVIDIA’s presence from infrastructure into the application layer, making its technology stickier and harder to replace

- Competitive Moat: Strengthens defense against emerging competitors like AMD’s MI300 series and Intel’s Gaudi chips by embedding NVIDIA technology deeper into operational workflows

- Recurring Revenue Streams: The partnership enables continuous optimisation capabilities that can be run hourly, creating ongoing demand for NVIDIA’s computing power

Palantir’s Market Position Enhancement

Palantir gains equally compelling advantages:

- Technology Acceleration: Integration with NVIDIA’s Blackwell architecture and Nemotron reasoning models enables faster AI agent development and deployment

- Competitive Differentiation: While competitors like Snowflake, Databricks, and Microsoft Azure AI offer analytics platforms, Palantir now uniquely combines operational AI with the most advanced GPU acceleration

- Government Contracts: The partnership strengthens Palantir’s position in defense and intelligence sectors, where real-time decision-making powered by NVIDIA GPUs provides mission-critical advantages

- Enterprise Sales Acceleration: Early adopter Lowe’s (home improvements) demonstrates the value proposition using the integrated stack to create digital twins of global supply chains for dynamic optimisation

Cloud Service Providers (Selective Winners)

Major cloud platforms that host both NVIDIA and Palantir technologies benefit from increased infrastructure demand.

Microsoft Azure, AWS, and Google Cloud will see elevated consumption as enterprises scale AI operations using the integrated stack.

Supply Chain Partners

TSMC, as NVIDIA’s primary foundry, will experience increased chip demand.

Companies providing AI infrastructure components such as cooling solutions, data center equipment, and networking hardware will see rising orders.

The Losers

Direct AI Platform Competitors

Several categories of competitors face significant pressure:

Enterprise AI Software Vendors: Companies like C3.ai, IBM Watson, Databricks, and Snowflake now compete against an integrated hardware-software stack that offers superior performance for operational AI.

While these platforms excel in specific use cases e.g. Snowflake for structured analytics, and Databricks for ML experimentation, both lack the tightly integrated GPU acceleration that Palantir now provides.

Defense Technology Competitors: Palantir’s rivals in government contracts, Leidos Holdings, CACI International, and Govini, face heightened competitive pressure.

Palantir’s AI-powered capabilities, now accelerated by NVIDIA, strengthen its position in programs like Maven (battlefield intelligence) and expand its European defense footprint through partnerships in Poland and the UK.

Hyperscalers’ Custom Silicon Efforts

Google (TPUs), Amazon (Trainium/Inferentia), and Microsoft (Maia) have invested billions developing custom AI chips to reduce dependence on NVIDIA.

The NVIDIA-Palantir partnership complicates these efforts by:

- Creating enterprise demand specifically for NVIDIA-accelerated solutions

- Building software ecosystems optimized for CUDA rather than proprietary frameworks

- Demonstrating clear performance advantages in operational AI use cases

While hyperscalers will continue developing custom silicon for internal workloads, the partnership makes it harder to convince enterprise customers to adopt non-NVIDIA alternatives.

AMD and Intel

NVIDIA’s primary chip competitors face renewed pressure:

AMD: Despite progress with MI300 and upcoming MI350 series, AMD’s software ecosystem lags NVIDIA’s mature CUDA platform.

The NVIDIA-Palantir partnership partnership further widens this gap by embedding NVIDIA technology into critical enterprise workflows, making switching costs prohibitively high.

Intel: Already struggling with its Gaudi AI accelerators, Intel’s value proposition of 50% cost savings becomes less compelling when enterprises prioritise the proven performance and ecosystem integration that NVIDIA-Palantir delivers.

Traditional Defense Contractors

Established defense players like Raytheon Technologies, Northrop Grumman, and Lockheed Martin face disruption as Palantir’s software-first approach gains traction over hardware-centric systems.

The NVIDIA-Palantir partnership accelerates this shift, enabling real-time battlefield intelligence and decision-making that legacy systems cannot match.

Market Dynamics and Implications

The Enterprise AI Stack Consolidation

So what does this mean for organisations?

The NVIDIA-Palantir partnership signals a broader trend toward integrated, turn-key AI platforms rather than fragmented DIY data stacks.

Enterprises increasingly favor solutions where hardware, software, and AI models work seamlessly together, reducing complexity and time-to-value.

This creates a winner-take-most dynamic where integrated platforms capture disproportionate market share.

Companies offering point solutions, whether specialised chips, analytics software, or ML tools, must either integrate into larger ecosystems or accept niche positions.

Competitive Response Scenarios

Competitors face difficult strategic choices:

Software Vendors: Must decide whether to optimise for NVIDIA (following Palantir’s lead) or maintain platform-agnostic approaches that sacrifice performance.

Companies like Databricks and Snowflake are pursuing partnerships with Palantir rather than direct competition, acknowledging the power of integrated stacks.

Chip Makers: AMD and Intel must accelerate software ecosystem development while competing on both performance and cost.

AMD’s acquisition of compiler specialists and partnerships with Hugging Face represent steps in this direction, but closing the gap with CUDA remains challenging.

Hyperscalers: Google, Amazon, and Microsoft must balance internal custom silicon development with continued NVIDIA partnerships, recognising that enterprise customers increasingly demand NVIDIA-powered solutions.

Future Outlook

The NVIDIA-Palantir partnership positions both companies to capture a significant share of the enterprise AI market, projected to reach $229 billion by 2030.

Several factors will determine ultimate success:

- Execution on Customer Deployments: Lowe’s pioneering supply chain optimisation demonstrates proof-of-concept. But scaling across hundreds of enterprise customers will test both companies’ implementation capabilities.

- Competitive Innovation: AMD, Intel, and hyperscalers will continue investing in alternatives. If they achieve comparable performance with better economics, customer loyalty may prove fragile.

- Regulatory Scrutiny: NVIDIA faces antitrust concerns in multiple jurisdictions, while Palantir’s government contracts attract political attention. Regulatory actions could constrain the partnership’s reach.

- Technology Evolution: The AI landscape remains fluid. Breakthroughs in model efficiency, edge computing, or alternative architectures could disrupt today’s GPU-centric paradigm.

Strategic Implications for the AI Ecosystem

The NVIDIA-Palantir partnership represents more than a commercial agreement. It establishes a template for how AI technology will be delivered to enterprises.

The winners are companies that control integrated stacks spanning hardware, software, and AI models.

The losers are those offering fragmented point solutions without clear differentiation or ecosystem advantages.

For enterprises, The NVIDIA-Palantir partnership simplifies AI adoption but creates new vendor dependencies.

For investors, The NVIDIA-Palantir partnership highlights the importance of ecosystem positioning over standalone capabilities.

And for competitors, The NVIDIA-Palantir partnership raises the bar for what constitutes a complete enterprise AI offering, forcing difficult decisions about partnerships, acquisitions, or niche specialization.

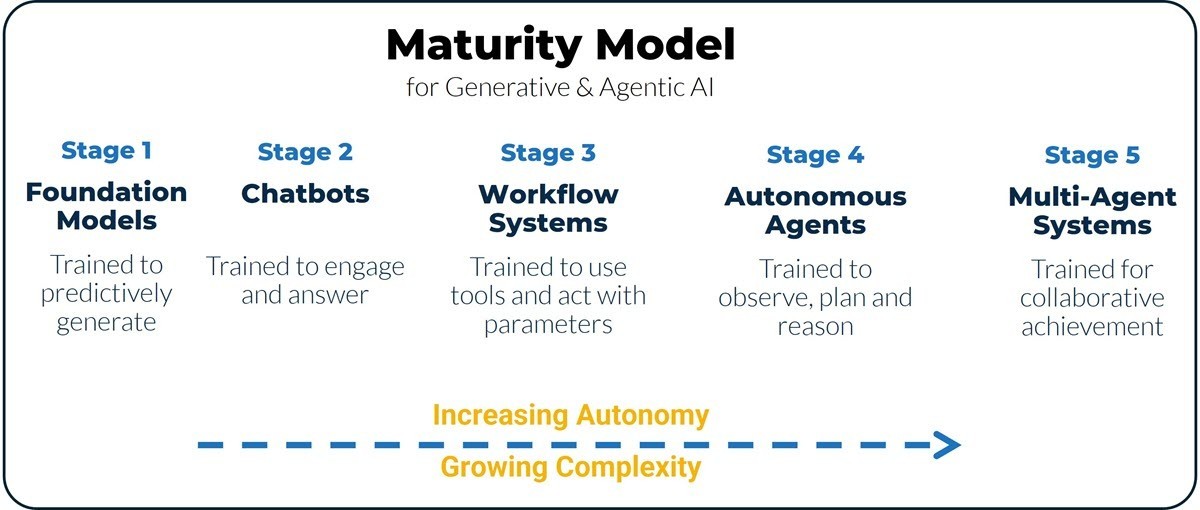

Accelerating Agentic AI Maturity

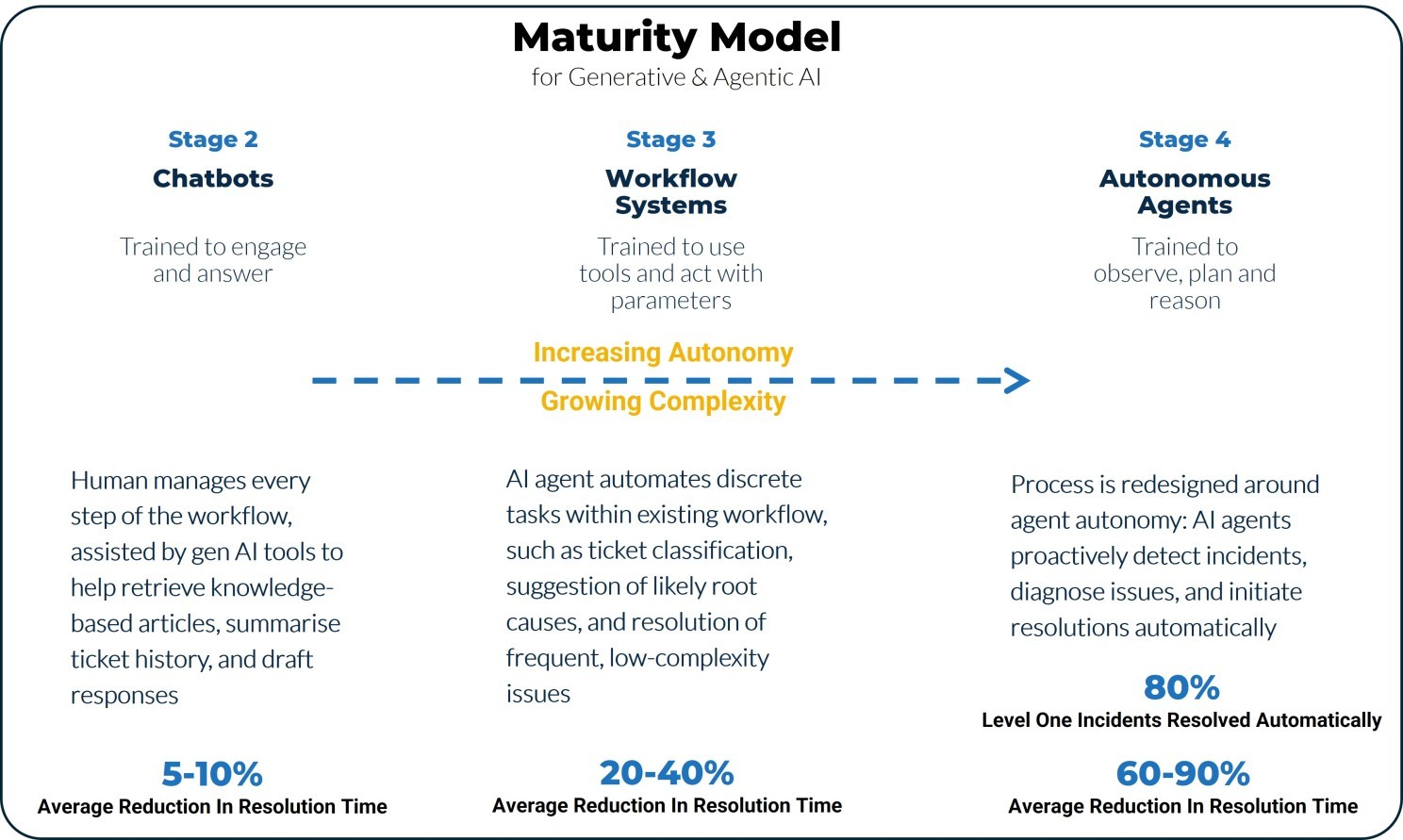

The NVIDIA-Palantir partnership creates what amounts to an industrial-grade fast track from Stage 3 (orchestrated automation) toward Stages 4-5 (proactive and autonomous agency), compressing timelines.

The integrated stack makes Stage 3 deployment dramatically faster and more accessible. This is significant in that stage 3 is where many organisations are currently focused and therefore has near term relevance for them.

Previously, organisations needed to assemble disparate components, GPU infrastructure, AI models, workflow orchestration, and domain knowledge, all of which required 18-36 months for enterprise implementation.

The turnkey Palantir-NVIDIA solution reduces this to potentially 6-12 months for motivated enterprises.

Lowe’s early deployment demonstrates this acceleration. The retailer is already using the integrated stack to create digital twins of global supply chains with continuous optimisation capabilities.

This represents sophisticated Stage 3 implementation: workflow automation with embedded intelligence now achievable in months rather than years.

The barrier isn’t technology availability anymore, it’s organisational readiness.

Stage 4 Timeline Compression: 2027-2030 becomes 2026-2028

The partnership’s most significant impact targets Stage 4 timeline (proactive, self-initiated action). Several technical and commercial factors suggest 18-24 month acceleration:

Infrastructure Readiness: real-time environmental perception and complex reasoning at scale.

Proof-of-Concept Momentum: systems observing data patterns, predicting customer needs, and proactively contacting customers with solutions are no longer 2027-2028 projections.

Early adopters like Lowe’s are piloting these capabilities now for 2026 production deployment.

Market Acceleration Dynamics: the NVIDIA-Palantir stack accelerates the technology challenges in stage 4 adoption by providing pre-integrated capabilities that previously required bespoke development.

Stage 5 Timeline: still 2028-2030, but with caveats

Stage 5 in the maturity model which is fully autonomous, self-directed goal-setting with emergent multi-agent collaboration remains technically and organisationally challenging.

The NVIDIA-Palantir partnership doesn’t fundamentally alter this timeline for several reasons:

- Governance and Trust Barriers: True Stage 5 requires organisations to cede goal-setting authority to AI systems, not just execution. This is primarily an organisational and cultural challenge rather than a technical one. The NVIDIA-Palantir partnership solves infrastructure problems but doesn’t address the governance frameworks, risk management protocols, and stakeholder trust building required for Stage 5 adoption.

- Multi-Agent Orchestration Complexity: While the partnership enables sophisticated single-agent deployments, emergent collaboration among multiple autonomous agents pursuing independent goals remains a research frontier.

- Regulatory and Accountability Questions: Your framework’s emphasis on human accountability and oversight aligns with emerging regulatory thinking. Stage 5 deployment will be governed by regulatory timelines as much as technical readiness. The EU AI Act, US executive orders, and sector-specific frameworks won’t permit Stage 5 autonomy until accountability mechanisms mature. However, selective Stage 5 deployments in controlled environments (supply chain optimisation, financial trading, defense applications) may arrive 12-18 months earlier. Palantir’s defense partnerships and Lowe’s logistics applications create regulatory sandboxes where Stage 5 capabilities can be tested under human oversight before broader release.

Revised Customer Contact Transformation Roadmaps

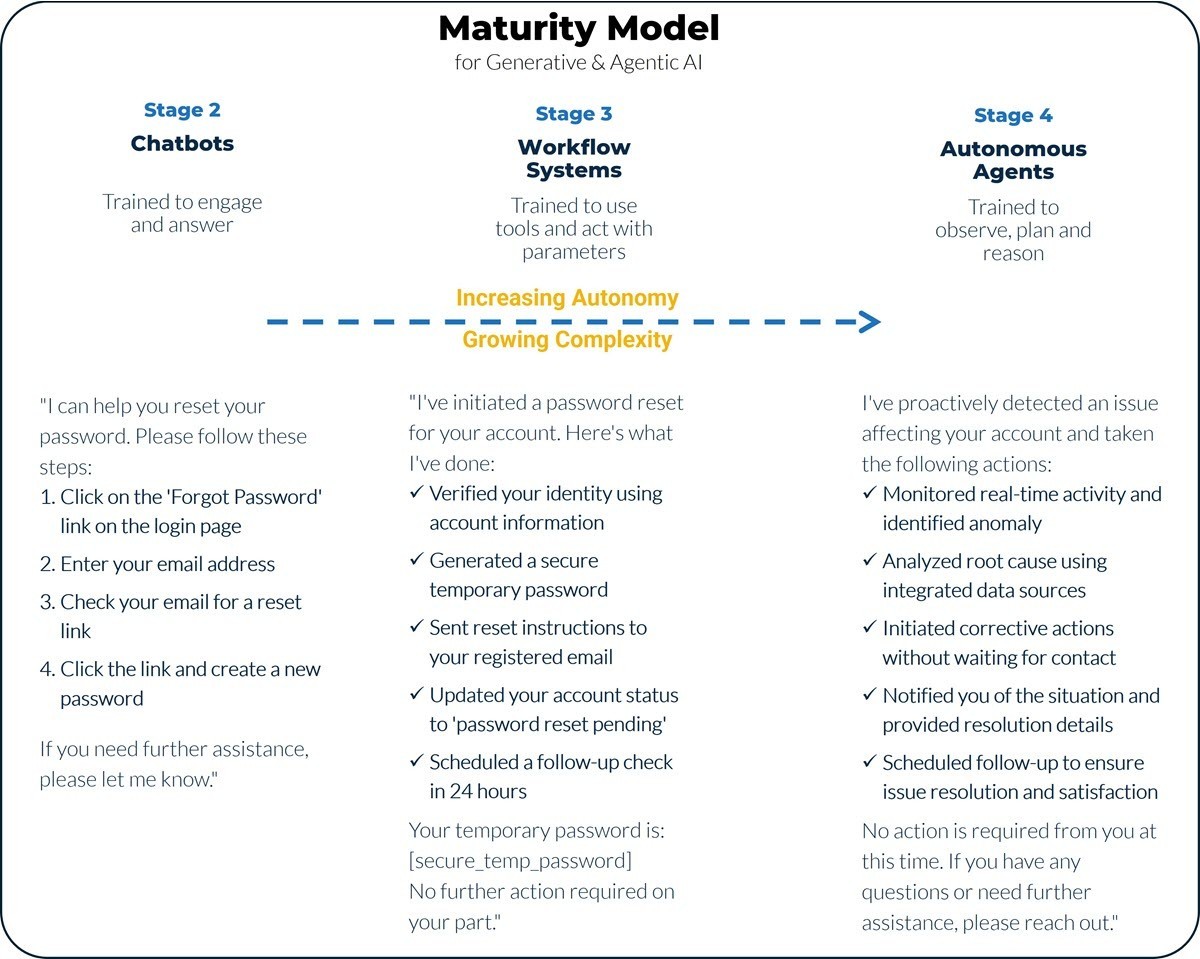

More becomes possible faster.

2025-2026 (Previously 2025-2027): Stage 3 deployment—AI-executed workflows with generative assistance becomes the achievable standard for forward-leaning contact centers.

This password reset example becomes immediately deployable rather than 18-24 months away.

2026-2028 (Previously 2027-2029): Stage 4 proactive engagement “I’ve proactively detected an issue and resolved it” transitions from aspirational to operational for early adopters.

Observing patterns, predicting needs, and proactively contacting customers becomes achievable 12-18 months earlier than previously forecast

Strategic Implications

The partnership creates a first-mover advantage window narrower than many organisations might assume.

Those reaching Stage 3 maturity in 2025-2026 have perhaps 18 months before competitors catch up, compared to the 24-36 month windows typical of previous technology waves.

Stage 3-4 adoption has narrowed from 3-5 years to 18-30 months. Organisations delaying deployment waiting for “more mature” technology will find themselves 24-36 months behind competitors who act in 2025-2026.

Organisational readiness becomes the primary constraint. Data quality, governance frameworks, change management, and stakeholder engagement shifts from important to critical.

Technology readiness no longer differentiates. Everyone has access to the NVIDIA-Palantir stack (or equivalent integrated platforms from Microsoft, Google, or AWS).

Winners are determined by who can deploy it fastest and most effectively.

But research still reports many are failing to do either. Responding to this critical need, Brainfood Training now offers in-depth readiness assessments calibrated to each stage in the Agentic Maturity model. If you want to understand what they are and when to use them, please get in touch for a walk through.

Thank you for reading.